I have started this blog, PolicyDad, to share some of my insights in regards to Risk Management, Twin Parenting, and how the two are nearly identical. I will share some facts in regards to how insurance works, and I will also share how the strategies insurance companies specialize in can be used to make your family better off.

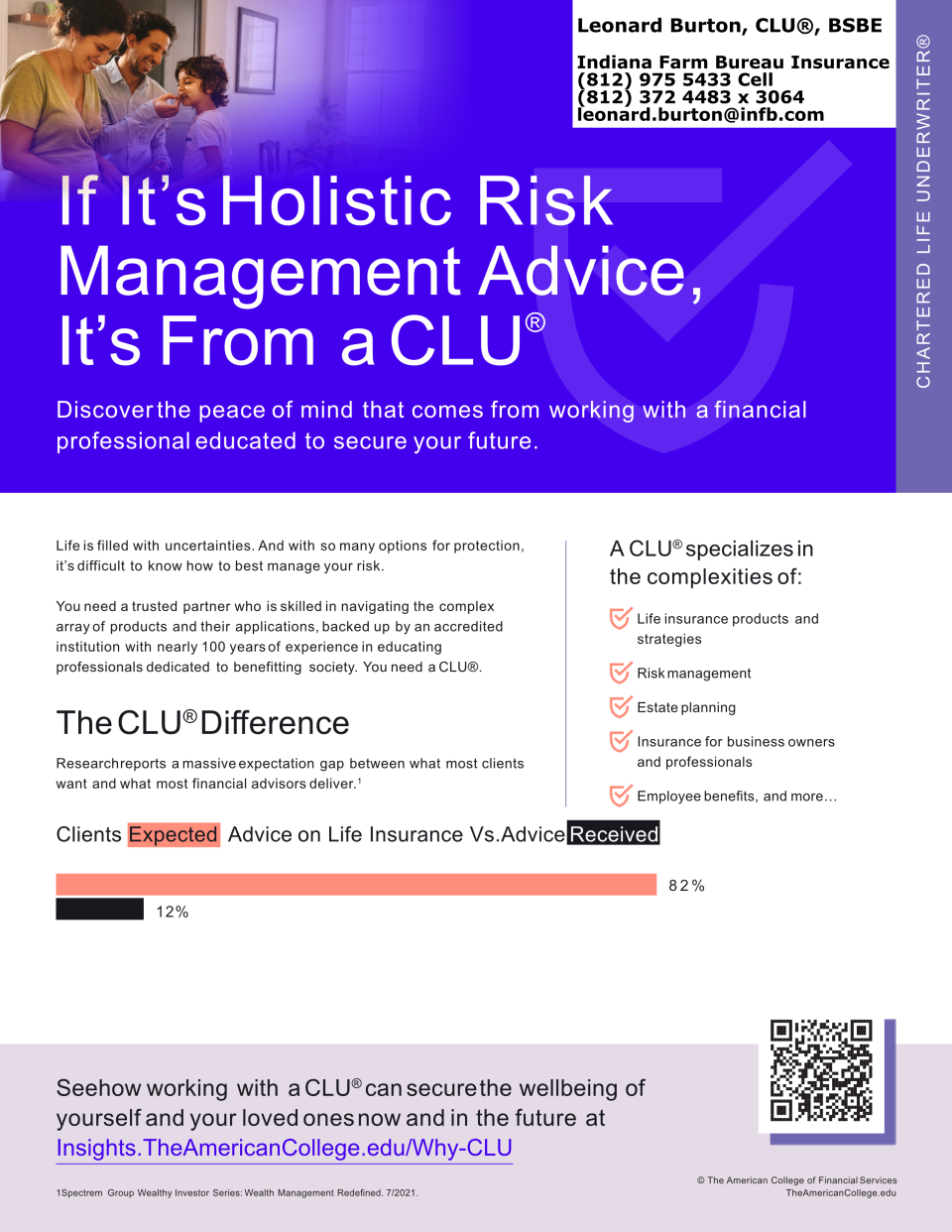

I came to the world of insurance in 2019 at the age of 42, and it forever changed my life. On my fifth day in the world of insurance, I found out my wife was carrying a baby - Two weeks later, I found out it was twins. Risk management has defined my life, not only professionally, but raising and protecting my family. Though insurance is a part of this Risk Management, there are other ways I manage our risks, and I hope that you can employ some of them as well.

To Help Families Protect What Matters Most

I want you to sleep soundly at night knowing that if something happens, you have been able to take care of your family. Yes, this starts with an insurance policy, but, more importantly, you will be better off if you know how to use an insurance to your best advantage.

To Build a Community of Families Looking Out for Each Other

I hope that through this blog we can connect and share ways of how we all live better. I will be occasionally critiquing other's social media content, and hope to do so in a positive way that helps all of us grow and take care of families! I hope others will share their insights into what I write as well.

To Educate Without the Sales Pitch

I love my job as an insurance agent, but I want to be able to share with you the power of arguably the most important financial tool you can ever use. It won't be my goal to sell you a policy, but for all of us to learn together in a way that makes life better for everyone!

To Provide Education, Not Advice

My goal here is to simply educate, as many people have a hard time truly understanding the nuances of insurance policies. I hope my words will help families protect their dreams from the worst. I want to educate without providing advice in this blog.

Advice is what I give my insured after we sit down and have an in-depth review of their financial and personal situation. I just simply can't do that over a blog post!

To Leave a Legacy of Financial Empowerment

I've watched people who make money I can only dream of living paycheck to paycheck. I've watched them only get by because previous family members set restrictions on how money was given out. I've watched them have their cars repossessed 2-3 times, not because they don't make enough money, but because they can't budget and live within the needs of the month.

Financial planning - including Risk Management and Insurance - works best when you have the right team. One of the goals of this blog is to give you the tools to build that team, so you can make informed decisions and feel confident in your financial future.

.