How do I know if something is likely covered?

Introduction

I often get asked, "Lenny What does insurance cover?"

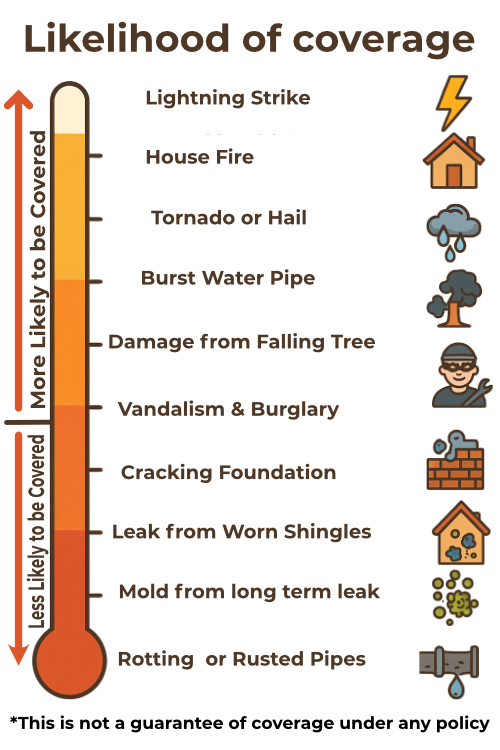

Sometimes its a really easy answer, sometimes it's easier to say what's not covered. Of course, insurance typically is reserved for things that are considered sudden and accidental, and not things that result from intentional acts or neglect. Insurance isn't designed as a substitute for proper maintenance.

If you believe what happened may have been sudden and accidental, then it might be good to have a conversation with your agent to see if filing a claim is a good idea. In the future, we'll talk about ways you can use to determine if you should file a claim or not. Part of the goal of today's article is to give you some indication as to if something may be covered or not. Only a company's claims adjuster can determine if something is covered as they will review the policy manual of your specific policy to make sure there are no exclusions.

What makes something “Sudden and Accidental”?

Typically speaking, things that are Sudden and Accidental are easy to recognize. Did you get into a car crash? Did a tree fall on your house? Did a pipe burst in your house not resulting from a lack of maintenance? Then, you very well may have a claim that could be covered.

Was the damage found from a slow leak that had been going for a long while? Then maybe it won't be covered because it isn't sudden and accidental.

Of course an insurance company's policy manual will describe their exact definition, but one that seems to come up a lot "Sudden and accidental means an abrupt, fortuitous* event which is unintended from the perspective of a reasonable person." . *Meaning: In a legal context, "fortuitous" describes an event that happens by chance, accident, or good luck, and is beyond the control of the parties involved, particularly in the context of contracts or other legal agreements. It signifies an occurrence that is not predictable or reasonably foreseen.

35 Commonly Denied Insurance Claims

🏠 Homeowners Insurance (14)

- 🏚️ Rotting Wood or Rusted Pipes (gradual wear & tear)

- 🏠 Roof Leak from Worn Shingles (aging and maintenance)

- 🌫️ Mold from Long-Term Leak (not sudden & accidental)

- 💧 Water Seepage from Cracked Foundation (gradual, not sudden)

- 🐜 Termite or Pest Damage (preventable infestation)

- 🌳 Tree Root Damage to Plumbing (maintenance issue)

- 🧱 Cracked Foundation from Settling (natural aging, not covered)

- 🛠️ Water Damage from Clogged Gutters (lack of maintenance)

- 🌿 Algae or Mold on Siding (environmental, gradual)

- 🧼 Cracked Grout or Caulking (maintenance failure)

- 🎨 Peeling Paint or Wallpaper (cosmetic, wear & tear)

- 🌊 Warped Flooring from Humidity (environmental, not covered)

- ☀️ Faded or Damaged Siding from Sun Exposure (natural aging)

- 🌲 Damage from Overgrown Vegetation (preventable maintenance)

🚗 Auto Insurance (8)

- 🚗 Engine Damage from Lack of Oil Changes (maintenance neglect)

- 🛞 Tire Blowouts from Worn Tires (wear & tear, not sudden)

- 🌧️ Rust Damage from Salt Exposure (gradual, environmental)

- ⚙️ Transmission Failure from Neglected Fluid Changes (maintenance)

- 🔧 Mechanical Breakdown Without Collision (not covered unless special policy)

- 🔋 Battery Failure from Lack of Use (gradual, not sudden)

- 🏎️ Damage from Improper Modifications (policy exclusions)

- 🚐 Undisclosed Commercial Use of Personal Vehicle (denial for misrepresentation)

🏦 Life Insurance (10)

- 🚫 Death During Illegal Acts (exclusion in many policies)

- 💊 Death from Drug or Alcohol Overdose (may be excluded)

- 🪂 Death from High-Risk Activities (e.g., skydiving, racing)

- 📝 Death from Non-Disclosure of Health Conditions (material misrepresentation)

- 📅 Death During the Contestability Period (policy under review)

- 🚬 Death from Tobacco Use Not Disclosed (material misrepresentation)

- ❗ Death from Suicide (within exclusion period, usually 2 years)

- ⚖️ Death During Commission of a Felony (exclusion clause)

- ⚠️ Death from Dangerous Hobbies (e.g., scuba, piloting)

- 🧭 Death from Travel to Excluded Countries (risk exclusions)

🏢 Commercial Insurance (10)

- 🏭 Wear and Tear on Machinery (gradual deterioration not covered)

- 🧲 Rust or Corrosion on Equipment (maintenance issue)

- 🛠️ Damage from Improper Installation (not sudden & accidental)

- 💧 Gradual Water Seepage into Building (seen as maintenance)

- 🌬️ Failure of HVAC Due to Lack of Maintenance (not sudden)

- 🐭 Pest Infestation Damage (e.g., rodents in warehouse) (preventable)

- 🧱 Settling or Cracking of Foundations (not sudden & accidental)

- 🏚️ Mold Damage from Unmaintained Roof (gradual problem)

- 📦 Damage to Stock from Improper Storage (preventable, excluded)

- 🔒 Business Interruption from Lack of Proper Risk Controls (exclusions for non-compliance)

How to Protect Yourself: An Ounce of Prevention is Worth a Pound of Cure!

Look at the list above, and see the common claim denials and fix any possible issues before anything happens. When is the last time you looked under your house? Do you have any missing shingles on your roof?

Is it time to replace your roof? We will discuss roofs in a future installment, but when have you looked in your attic and on top of your roof last?

Are your fire extinguishers up-to-date? Do any of your plumbing fixtures need replacement?

An ounce of prevention is worth a pound of cure - don't cost yourself lots of money just because something that could have been fixed wasn't.

Too Long, Didn't Read!

Get your Annual X-Ray!! Yes, you need to meet with your agent every year!

Reminder: Insurance is designed for sudden, unexpected events—not gradual wear, preventable issues, or high-risk situations that fall outside policy terms.